Top 3 Recommended Policies

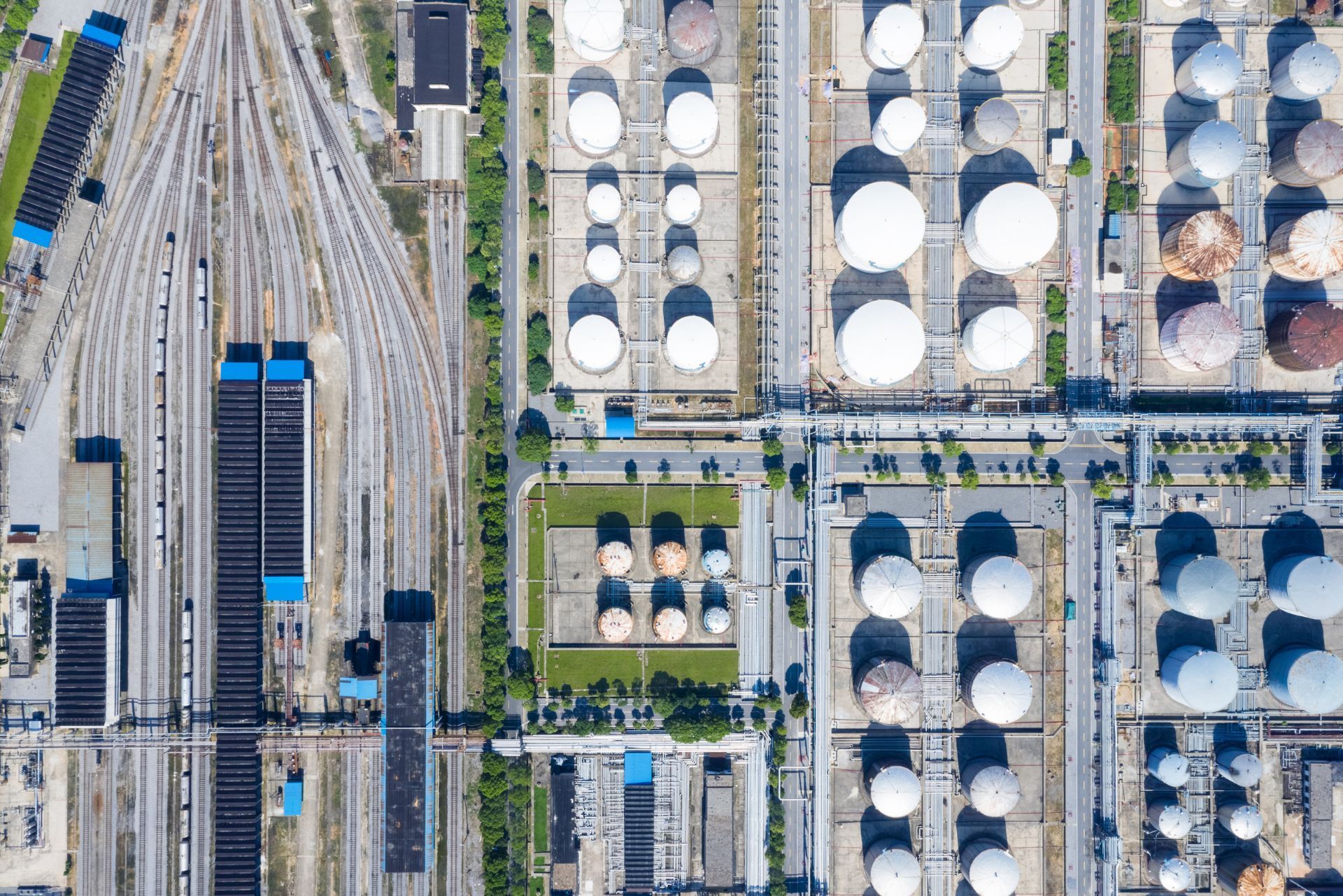

Operating an oil storage terminal involves managing significant risks, from environmental hazards to infrastructure challenges. Insurance plays a critical role in protecting operators against financial losses stemming from accidents, natural disasters, and evolving market conditions. This comprehensive guide explores the complexities of insurance for oil storage terminal operators, highlighting current trends, challenges, and strategies to navigate this essential aspect of the energy sector.

The Growing Importance of Property Insurance in Oil and Gas

The property insurance market within the oil and gas sector is experiencing robust growth, reflecting the increasing value and risks associated with energy infrastructure. Valued at $75 billion in 2023, this market is projected to surge to $135 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.2%. This expansion underscores the rising demand for comprehensive coverage tailored to the unique needs of oil storage terminal operators.

Such growth is driven not only by the sheer scale of assets requiring protection but also by the evolving risk landscape. Aging infrastructure, market volatility, and the integration of new technologies all contribute to the complexity of insurance requirements. Operators must stay informed about these trends to ensure adequate protection.

In addition to the physical risks associated with oil and gas operations, there is an increasing focus on environmental liabilities. Incidents such as oil spills or gas leaks can lead to significant financial repercussions, not only from remediation costs but also from potential legal claims and regulatory fines. As public awareness of environmental issues rises, companies are under pressure to adopt more sustainable practices, which in turn influences their insurance needs. Insurers are now developing specialized policies that address these environmental risks, providing operators with coverage that aligns with their sustainability goals.

Moreover, the geopolitical landscape plays a significant role in shaping the property insurance market. Political instability in oil-rich regions can lead to disruptions in supply chains, increasing the likelihood of losses. Insurers are adapting to these challenges by offering products that account for political risk, ensuring that operators are safeguarded against unforeseen events that could impact their operations. This evolving approach not only enhances the resilience of companies in the sector but also fosters a more stable investment environment, attracting further capital into the oil and gas industry.

For a detailed overview of market growth and forecasts, the

verifiedmarketreports.com analysis offers valuable insights into the sector’s trajectory.

Key Challenges Facing Oil Storage Terminal Insurance

Rising Insurance Costs and Coverage Issues

One of the most pressing concerns for oil storage terminal operators is the steady increase in insurance premiums. Ryan Edgmon, managing director of the energy division at Higginbotham Insurance and Financial Services, highlights that companies in the oil and gas industry are grappling with rising costs driven by factors such as increased auto insurance claims and higher umbrella coverage requirements. These challenges translate into higher operational expenses and more stringent underwriting processes.

Additionally, social inflation—characterized by rising claims costs and larger jury awards—is exerting upward pressure on insurance rates. Between 2010 and 2019, median jury awards in the energy sector rose significantly, with some verdicts reaching multimillion-dollar levels. This trend complicates risk assessment and necessitates more comprehensive coverage strategies. Insurers are increasingly cautious, leading to a more rigorous evaluation of potential risks associated with oil storage operations, which can delay policy approvals and increase the time and resources needed to secure coverage.

Understanding these dynamics is crucial for operators aiming to balance cost with adequate protection. More on these insurance challenges can be found in the MRT.com report and the Insurance Advocate’s analysis. Furthermore, the evolving regulatory landscape and increasing environmental scrutiny are compelling operators to reassess their risk profiles, prompting a shift towards more sustainable practices that could potentially influence insurance premiums in the long run.

Collateral Requirements and Operational Impact

Beyond premium increases, oil storage terminal operators face heightened collateral demands from insurers. Companies are often required to provide new or larger collateral deposits to secure coverage, which can strain financial resources and complicate cash flow management. These requirements reflect insurers’ efforts to mitigate risk exposure amid a volatile market environment. The collateral demands can vary significantly depending on the specific risks associated with each terminal, such as geographic location, historical loss data, and the types of products stored, further complicating the financial landscape for operators.

Such operational burdens underscore the importance of proactive risk management and transparent communication with insurers. By demonstrating robust safety protocols and maintenance practices, operators may negotiate more favorable terms and reduce collateral obligations. Additionally, investing in technology that enhances monitoring and reporting can provide insurers with the data needed to assess risks more accurately, potentially leading to lower collateral requirements. As the industry continues to evolve, staying ahead of these trends will be essential for terminals to maintain operational efficiency while navigating the complexities of insurance.

For a deeper dive into these insurance market factors, the AOGR report provides an in-depth perspective. Additionally, exploring case studies of terminals that have successfully adapted to these challenges can offer valuable insights into effective strategies for managing insurance costs and operational risks in an increasingly demanding environment.

Impact of Market and Environmental Factors on Insurance Premiums

Stabilization of Downstream Energy Property Premiums

After a period of record-high premiums in 2023, recent data indicates a stabilization of downstream energy property insurance costs in 2024. This moderation is attributed to a combination of fewer significant losses, a reduction in natural disasters affecting energy assets, and ample insurance supply in the market. For oil storage terminal operators, this trend offers a window of opportunity to reassess coverage needs and potentially negotiate better rates.

However, this stabilization should not lead to complacency. The energy sector remains susceptible to sudden shifts in risk profiles, particularly as climate events and geopolitical tensions evolve. Maintaining vigilant risk assessment and insurance review processes is essential to adapt to these changes. Additionally, the rise of renewable energy sources and advancements in technology are reshaping the landscape of risk management. Companies that proactively embrace these innovations may find themselves better positioned to mitigate risks and lower their premiums over time.

Insights into these premium trends are available through IMACorp’s market analysis.

Regional Variations in Inspection and Compliance Costs

Inspection costs, a critical factor influencing insurance premiums, vary significantly by region due to differing regulatory requirements. For example, a 2022 study found that tanks in California incur 18% higher inspection costs than those in Texas, primarily because of mandatory vapor recovery system assessments. These additional compliance measures increase operational expenses and can indirectly affect insurance pricing. Furthermore, as states implement stricter environmental regulations, operators may face increased scrutiny, leading to even higher compliance costs that could further impact their insurance premiums.

Operators must factor in these regional disparities when budgeting for insurance and maintenance. Understanding local regulations and investing in compliance can reduce the risk of costly claims and penalties, ultimately benefiting insurance negotiations. Moreover, engaging with local regulatory bodies and participating in industry forums can provide valuable insights into upcoming changes in legislation, allowing operators to stay ahead of compliance requirements. This proactive approach not only helps in managing costs but also enhances the overall safety and reliability of operations, which can be a significant selling point during insurance discussions.

More details on these inspection cost variations can be found in the PMarketResearch.com study.

Technological Integration and Its Dual Impact on Insurance

Opportunities and Risks of Advanced Technologies

The integration of advanced technologies into oil storage terminals—such as automation, IoT sensors, and data analytics—offers significant benefits in operational efficiency and risk management. These innovations enable real-time monitoring, predictive maintenance, and enhanced safety protocols, which can reduce the frequency and severity of incidents. For instance, IoT sensors can continuously track the condition of storage tanks, providing alerts for any anomalies, which can help in preventing leaks or spills before they occur. This proactive approach not only safeguards the environment but also minimizes potential regulatory fines and reputational damage.

However, technological adoption also introduces new vulnerabilities, particularly in cybersecurity. As terminals become more connected, they face increased risks of cyberattacks that can disrupt operations and cause substantial financial losses. The potential for ransomware attacks, where critical systems are locked until a ransom is paid, is a growing concern in the industry. Insurers are increasingly factoring these cyber risks into their coverage assessments, which can influence premium levels and policy terms. Additionally, the complexity of these technologies means that traditional risk management strategies may no longer suffice, necessitating a reevaluation of existing policies to encompass the full spectrum of digital threats.

Balancing the advantages of technology with its associated risks requires a strategic approach to insurance and risk management. Operators should collaborate closely with insurers to ensure that cyber exposures are adequately addressed in their policies. This collaboration can also extend to developing tailored risk mitigation strategies, such as regular cybersecurity training for employees and investing in robust firewall systems. Moreover, the use of blockchain technology for secure transactions and data integrity can further enhance trust and transparency in operations, providing an additional layer of protection against potential breaches.

For a comprehensive overview of these technological impacts, refer to the TechSci Research report. This report delves into the latest trends in technology adoption within the oil sector, highlighting case studies of terminals that have successfully integrated these innovations while managing their associated risks effectively. Understanding these dynamics is crucial for stakeholders aiming to navigate the evolving landscape of oil storage and insurance.

Best Practices for Securing Effective Insurance Coverage

Comprehensive Risk Assessment and Documentation

Securing the right insurance coverage begins with a thorough risk assessment. Operators should evaluate all potential hazards, including environmental risks, equipment failures, and third-party liabilities. Detailed documentation of safety procedures, maintenance records, and compliance with regulations strengthens the insurer’s confidence and can lead to more favorable terms.

Regular audits and updates to risk profiles ensure that insurance policies remain aligned with the evolving operational landscape. This proactive approach minimizes coverage gaps and unexpected exposures. Furthermore, it is essential to involve all stakeholders in this assessment process, including employees and management, to gain a comprehensive understanding of potential risks. Engaging in scenario planning can also help identify less obvious threats, such as cyber risks or supply chain vulnerabilities, which are increasingly relevant in today's interconnected world. By anticipating these challenges, operators can better prepare their insurance strategies and ensure they are adequately covered against unforeseen events.

Engaging Specialized Insurance Brokers

Given the complexities of the oil and gas insurance market, partnering with brokers who specialize in energy sector risks is invaluable. These experts understand industry-specific challenges and can navigate the nuances of policy options, exclusions, and endorsements. Their insights help operators tailor coverage to their unique needs while optimizing costs. Additionally, specialized brokers often have established relationships with underwriters, which can facilitate smoother negotiations and potentially lead to more favorable terms.

Moreover, these brokers can provide invaluable market intelligence, keeping operators informed about emerging trends, regulatory changes, and new coverage options that may enhance their policies. They can also assist in benchmarking against industry standards, ensuring that operators are not only compliant but also competitive in their insurance strategies. By leveraging the expertise of specialized brokers, companies can gain a strategic advantage in managing their insurance portfolios effectively.

Investing in Loss Prevention and Safety Programs

Insurance providers reward operators who demonstrate commitment to loss prevention through robust safety programs, employee training, and emergency preparedness. Investing in these areas reduces the likelihood of claims and can positively influence premium rates and underwriting decisions. Comprehensive safety training programs that engage employees at all levels foster a culture of safety, which is critical in high-risk environments like oil and gas operations. Regular drills and simulations can prepare teams for real-life emergencies, ensuring that everyone knows their roles and responsibilities in a crisis.

Additionally, implementing advanced technologies such as predictive analytics and IoT devices can significantly enhance safety measures. These tools allow for real-time monitoring of equipment and operations, enabling early detection of potential issues before they escalate into costly incidents. By integrating technology into safety programs, operators not only improve their risk management but also demonstrate to insurers their proactive stance on safety, further solidifying their position for favorable coverage terms.

Conclusion: Navigating the Future of Oil Storage Terminal Insurance

Insurance for oil storage terminal operators is a dynamic and increasingly critical component of risk management. With the property insurance market in the oil and gas sector expected to grow substantially, operators must stay informed about market trends, regulatory changes, and technological developments.

Challenges such as rising premiums, collateral requirements, and social inflation require strategic planning and collaboration with knowledgeable insurance partners. Meanwhile, opportunities presented by technological advancements and market stabilization offer pathways to optimize coverage and control costs.

By embracing comprehensive risk assessments, engaging specialized brokers, and prioritizing safety, oil storage terminal operators can secure the insurance protection necessary to safeguard their assets and ensure long-term operational resilience. Staying ahead in this evolving landscape is essential for success in the competitive and high-stakes world of energy storage.

For ongoing insights into insurance trends and market dynamics, operators can consult resources like

IMACorp’s energy market reports and industry analyses from

AOGR.

Contact Us

Phone

Location

9595 Six Pines Dr, Suite 8210, The Woodlands, TX 77380