Top 3 Recommended Policies

Operating a wellhead installation business involves managing complex equipment and navigating various risks associated with the oil and gas industry. As the global wellhead equipment market is projected to grow significantly in the coming years, so too does the importance of having the right insurance coverage to protect your business from potential liabilities and financial losses. This comprehensive guide covers everything you need to know about wellhead installation business insurance, helping you make informed decisions to safeguard your operations.

Understanding the Wellhead Installation Industry Landscape

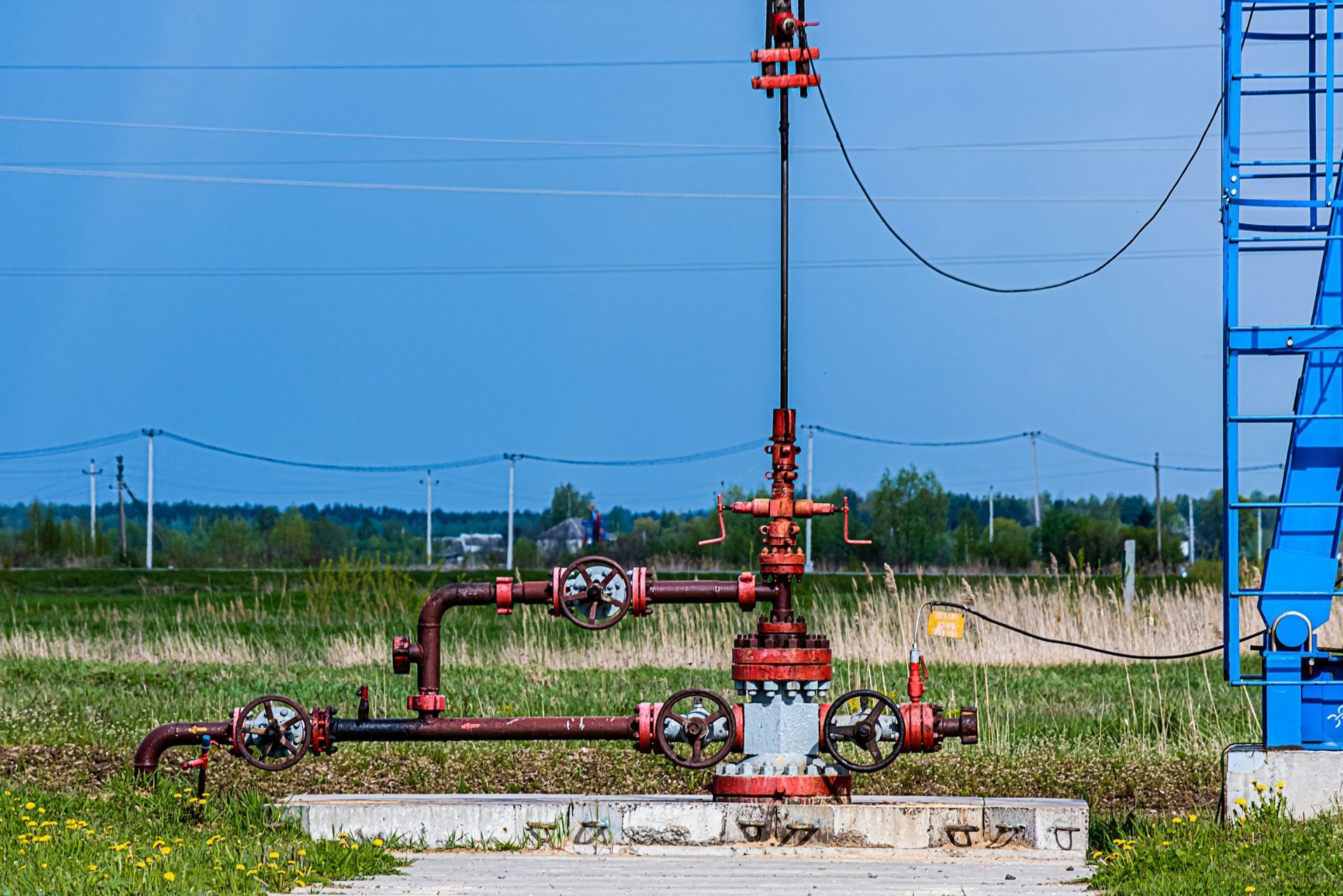

The wellhead installation sector plays a critical role in the oil and gas supply chain. Wellhead equipment serves as the interface between the drilling rig and the underground reservoir, ensuring safe and efficient extraction of hydrocarbons. With the global wellhead equipment market valued at USD 5.30 billion in 2023 and expected to reach USD 8.07 billion by 2032, the industry is experiencing steady growth driven by increasing energy demands and technological advancements.

This growth trajectory, with a compound annual growth rate (CAGR) of approximately 4.9% during the forecast period, highlights the expanding opportunities in wellhead installation services. However, it also underscores the increasing exposure to operational risks, equipment failures, and regulatory compliance challenges that businesses must navigate. As companies strive to optimize their operations, the integration of advanced technologies such as automation and real-time data analytics is becoming increasingly prevalent. These innovations not only enhance the efficiency of wellhead installations but also improve safety measures, allowing for quicker responses to potential issues that may arise during the extraction process.

Moreover, the wellhead installation industry is witnessing a shift towards sustainable practices, driven by the global push for cleaner energy sources and reduced environmental impact. Companies are now exploring ways to minimize their carbon footprint, including the adoption of more efficient wellhead designs and the use of environmentally friendly materials. This transition is not just a response to regulatory pressures but also a strategic move to align with the growing consumer demand for sustainable energy solutions. As a result, businesses that prioritize sustainability in their operations are likely to gain a competitive edge in the marketplace.

For more detailed market insights, the Fortune Business Insights report on the wellhead equipment market offers valuable data and projections.

Why Insurance is Essential for Wellhead Installation Businesses

Wellhead installation involves high-value equipment, specialized labor, and potentially hazardous environments. Insurance is not just a regulatory formality but a strategic necessity to protect your business against a wide range of risks including property damage, equipment breakdown, bodily injury, and environmental liabilities.

Without adequate insurance, a single incident could result in substantial financial losses or even jeopardize the survival of your business. Insurance policies tailored to this sector provide coverage for risks unique to wellhead installation, such as damage during transport and installation, third-party liabilities, and professional errors.

Moreover, many clients and contractors require proof of insurance before awarding contracts, making it a critical factor in maintaining business credibility and competitive advantage.

In addition to safeguarding against immediate financial repercussions, insurance can also facilitate smoother operations by ensuring compliance with local regulations and industry standards. Many regions have specific insurance requirements for businesses operating in the oil and gas sector, and having the right coverage can prevent costly fines and legal complications. Furthermore, a well-structured insurance policy can include risk management services that help identify potential hazards and implement preventative measures, thereby enhancing workplace safety and operational efficiency.

Additionally, the landscape of wellhead installation is evolving with advancements in technology and increasing environmental scrutiny. As businesses adopt new methods and equipment, they must also consider the associated risks. For instance, the integration of automated systems and drones for monitoring installations can introduce new liability concerns. Insurance providers often offer specialized policies that address these innovations, ensuring that businesses remain protected as they adapt to changing industry trends. This proactive approach not only mitigates risks but also positions companies as forward-thinking leaders in the wellhead installation market.

Key Types of Insurance Coverage for Wellhead Installation

General Liability Insurance

This coverage protects your business against claims of bodily injury or property damage caused by your operations. Given the heavy machinery and onsite hazards involved in wellhead installation, general liability insurance is fundamental to managing third-party risks. It not only covers legal fees and settlements but also provides peace of mind, allowing you to focus on the complexities of your project without the constant worry of potential lawsuits. By investing in this coverage, you demonstrate a commitment to safety and professionalism, which can enhance your reputation in the industry.

Equipment and Property Insurance

Wellhead equipment is expensive and essential to your operations. Equipment insurance covers damage or loss due to accidents, theft, or natural disasters. Property insurance protects your business premises and onsite assets. In addition, this type of insurance can also extend to cover temporary structures and tools that are often used during the installation process. Given the financial implications of replacing or repairing specialized equipment, having robust equipment and property insurance can be a game changer, ensuring that your operations can continue smoothly even in the face of unforeseen events.

Professional Liability Insurance

Also known as errors and omissions insurance, this coverage protects against claims arising from mistakes or negligence during the installation process. Given the technical precision required in wellhead installation, this insurance can safeguard your business from costly lawsuits. It is particularly important in a field where even minor oversights can lead to significant operational setbacks or safety hazards. This insurance not only covers legal costs but can also provide resources for risk management training and consultation, helping to minimize the chances of errors in the future.

Workers’ Compensation Insurance

Due to the hazardous nature of wellhead installation work, workers’ compensation insurance is crucial to cover medical expenses and lost wages for employees injured on the job. It also helps protect your business from related legal claims. Additionally, this insurance fosters a safer work environment by encouraging employers to prioritize safety measures and training. By demonstrating that you value your employees' well-being, you can boost morale and retention rates, which are vital in an industry often plagued by high turnover. Furthermore, some states may offer incentives for businesses that maintain a low incidence of workplace injuries, providing an additional financial benefit.

Environmental Liability Insurance

Oil and gas operations carry environmental risks such as spills and contamination. Environmental liability insurance covers cleanup costs and legal fees associated with environmental damage caused by your activities. This coverage is increasingly important as regulatory scrutiny intensifies and public awareness of environmental issues grows. In many cases, having this insurance can be a prerequisite for securing contracts or permits, as clients and regulatory bodies seek assurance that you are prepared to handle potential environmental liabilities responsibly. Moreover, this insurance can also provide support for implementing sustainable practices and technologies, further enhancing your company's commitment to environmental stewardship.

Market Trends Impacting Insurance Needs

The wellhead equipment market’s growth from USD 5.50 billion in 2024 to an anticipated USD 8.07 billion by 2032, with a CAGR of 5.0%, reflects expanding operations and technological advancements in the sector. This growth increases the scale and complexity of risks faced by installation businesses. As companies invest in more sophisticated technologies, such as automation and real-time monitoring systems, they are also exposed to new types of operational risks that necessitate tailored insurance solutions. The integration of artificial intelligence and machine learning in predictive maintenance, for example, not only enhances efficiency but also introduces unique liabilities that traditional insurance policies may not adequately cover.

Simultaneously, the global oil and gas insurance market, valued at USD 26.39 billion in 2023 and projected to reach USD 32.06 billion by 2032, is evolving to address these emerging risks. The insurance industry is developing specialized products to cover new technologies, regulatory changes, and environmental concerns. Insurers are now focusing on offering coverage that includes cyber risk, which has become increasingly pertinent as the sector embraces digital transformation. Moreover, as regulatory frameworks tighten around environmental sustainability, insurers are also crafting policies that incentivize companies to adopt greener practices, thereby aligning risk management with the global push for sustainability.

For those operating in North America, the downhole equipment insurance market alone accounted for approximately USD 1.2 billion in 2023, with a CAGR of about 5.5%, highlighting the region’s significant role in the sector and its insurance demands. These market dynamics emphasize the need for wellhead installation businesses to regularly review and update their insurance policies to keep pace with industry changes. Additionally, the ongoing geopolitical tensions and fluctuating oil prices can lead to unpredictable market conditions, further complicating risk assessment and management for businesses. As a result, companies are encouraged to engage with insurance professionals who specialize in the oil and gas sector to ensure they have comprehensive coverage that reflects the current landscape.

More information on the broader oil and gas insurance landscape can be found in the

Wise Guy Reports on oil and gas insurance market. Understanding these trends is crucial for stakeholders aiming to navigate the complexities of risk management in an ever-evolving industry.

Factors Influencing Insurance Premiums for Wellhead Installation Businesses

Several factors determine the cost of insurance premiums for wellhead installation companies. Understanding these can help businesses manage expenses while ensuring adequate coverage.

- Scope of Operations: Larger projects or those involving more complex installations typically carry higher risks and costs.

- Experience and Safety Record: Businesses with a strong track record of safety and compliance often benefit from lower premiums.

- Geographic Location: Operating in regions with higher environmental risks or stricter regulations may increase insurance costs.

- Equipment Value and Maintenance: Well-maintained, modern equipment reduces the likelihood of breakdowns and claims.

- Claims History: A history of frequent or severe claims can result in higher premiums.

Insurance providers assess these factors carefully to tailor policies that balance risk and affordability. Additionally, the type of insurance coverage selected can also significantly impact premiums. For instance, general liability insurance, which covers third-party bodily injury and property damage, is often a fundamental requirement for wellhead installation businesses. Companies may choose to enhance their coverage with specialized policies, such as environmental liability insurance, which protects against claims arising from pollution or environmental damage associated with wellhead operations. This type of coverage is particularly critical in areas where environmental regulations are stringent, as it can mitigate the financial repercussions of potential accidents or spills.

Moreover, the training and certification of employees play a crucial role in determining insurance costs. Companies that invest in comprehensive training programs for their workforce not only improve safety standards but also demonstrate their commitment to risk management. Insurers often view such proactive measures favorably, which can lead to discounts on premiums. Additionally, the implementation of advanced safety technologies, such as real-time monitoring systems and automated shut-off valves, can further enhance safety and reduce risk, ultimately influencing the overall cost of insurance. By prioritizing safety and compliance, wellhead installation businesses can create a more favorable insurance landscape for themselves.

Steps to Secure the Right Insurance for Your Wellhead Installation Business

Choosing the right insurance coverage requires a strategic approach. Here are key steps to guide the process:

1. Assess Your Risks Thoroughly

Identify all potential risks associated with your operations, including equipment damage, employee injuries, environmental hazards, and contractual liabilities. A comprehensive risk assessment forms the foundation for selecting appropriate insurance products. Consider conducting regular audits and involving employees in the risk identification process, as they can provide valuable insights into day-to-day operations and potential vulnerabilities that may not be immediately apparent.

2. Consult with Industry-Savvy Insurance Brokers

Work with brokers who specialize in oil and gas or industrial insurance. Their expertise ensures you receive coverage tailored to the unique challenges of wellhead installation. These professionals can help you navigate complex policy language and provide guidance on emerging risks in the industry, such as changes in environmental regulations or advancements in technology that may impact your operations.

3. Compare Policy Options and Coverage Limits

Evaluate different policies for coverage scope, exclusions, deductibles, and premium costs. Ensure the limits align with the scale of your operations and potential liabilities. It’s also wise to inquire about endorsements or additional coverages that can be added to your policy, such as coverage for business interruption or cyber liability, which are increasingly relevant in today’s digital landscape.

4. Review Regulatory Requirements

Stay informed about local and international regulations that may mandate specific insurance types or minimum coverage levels. Engaging with legal experts or industry associations can provide insights into compliance requirements and help you avoid costly penalties. Additionally, understanding these regulations can enhance your credibility with clients and stakeholders, showcasing your commitment to responsible business practices.

5. Implement Safety and Risk Management Practices

Adopting robust safety protocols and maintenance routines not only reduces risks but can also lower insurance premiums. Consider investing in training programs for your employees that focus on safety best practices and emergency response procedures. Furthermore, documenting your safety initiatives can serve as evidence of your commitment to risk management, which may positively influence your insurance negotiations.

6. Regularly Update Your Insurance Portfolio

As your business grows or changes, periodically review your insurance coverage to address new risks or operational expansions. This proactive approach ensures that you are not underinsured as your business evolves, particularly when taking on new projects or entering different markets. Keeping an open line of communication with your insurance broker can help you stay ahead of potential coverage gaps and ensure that your policy remains aligned with your business objectives.

Common Challenges and How Insurance Helps Overcome Them

Wellhead installation businesses face challenges such as equipment failures, onsite accidents, and environmental incidents. Insurance serves as a financial safety net, enabling companies to recover quickly from setbacks.

For example, if a critical piece of wellhead equipment is damaged during installation, equipment insurance can cover repair or replacement costs, minimizing downtime. Similarly, if an employee is injured onsite, workers’ compensation insurance ensures medical care and wage replacement, protecting both the worker and the business.

In the event of environmental contamination, environmental liability insurance helps cover cleanup expenses and legal fees, which might otherwise be financially devastating.

Conclusion: Protecting Your Wellhead Installation Business for Sustainable Growth

As the wellhead equipment market continues to expand, with projections reaching USD 8.07 billion by 2032, wellhead installation businesses must prioritize comprehensive insurance coverage to navigate the associated risks effectively. From general liability to environmental insurance, having the right policies in place safeguards your assets, employees, and reputation.

Investing time and resources into understanding your insurance needs, working with knowledgeable brokers, and maintaining strong safety practices will position your business for long-term success in a competitive and evolving industry.

For further insights on market trends and insurance solutions tailored to the oil and gas sector, consider exploring

the Insight Research Pro’s report on the wellhead system market, which offers valuable perspectives on future growth and risk management strategies.

Contact Us

Phone

Location

9595 Six Pines Dr, Suite 8210, The Woodlands, TX 77380