Top 3 Recommended Policies

The hydraulic workover unit (HWU) and snubbing services industry plays a critical role in the oil and gas sector, providing essential solutions for well maintenance, repair, and enhancement. With the global hydraulic workover unit market projected to reach $11.0 billion by 2025, growing at a compound annual growth rate (CAGR) of 6.3% from 2020, companies operating in this field face both immense opportunities and significant risks. Understanding the nuances of business insurance tailored to snubbing and hydraulic workover operations is vital for safeguarding assets, managing liabilities, and ensuring long-term success. This article explores the essentials of insurance coverage for businesses in this specialized sector, highlighting market trends, operational risks, and insurance considerations.

As the demand for repair, maintenance, and upgrading of existing wells continues to dominate the market—accounting for 77% of revenue in the workover service segment in 2023—businesses must be prepared to mitigate risks associated with complex and high-stakes operations. The integration of automation and digital monitoring technologies has improved operational efficiency by 25%, but it also introduces new dimensions of risk that insurance policies need to address. For those interested in the broader market context, MarketsandMarkets provides detailed forecasts and insights on the hydraulic workover unit market’s growth trajectory.

Understanding the Hydraulic Workover and Snubbing Industry

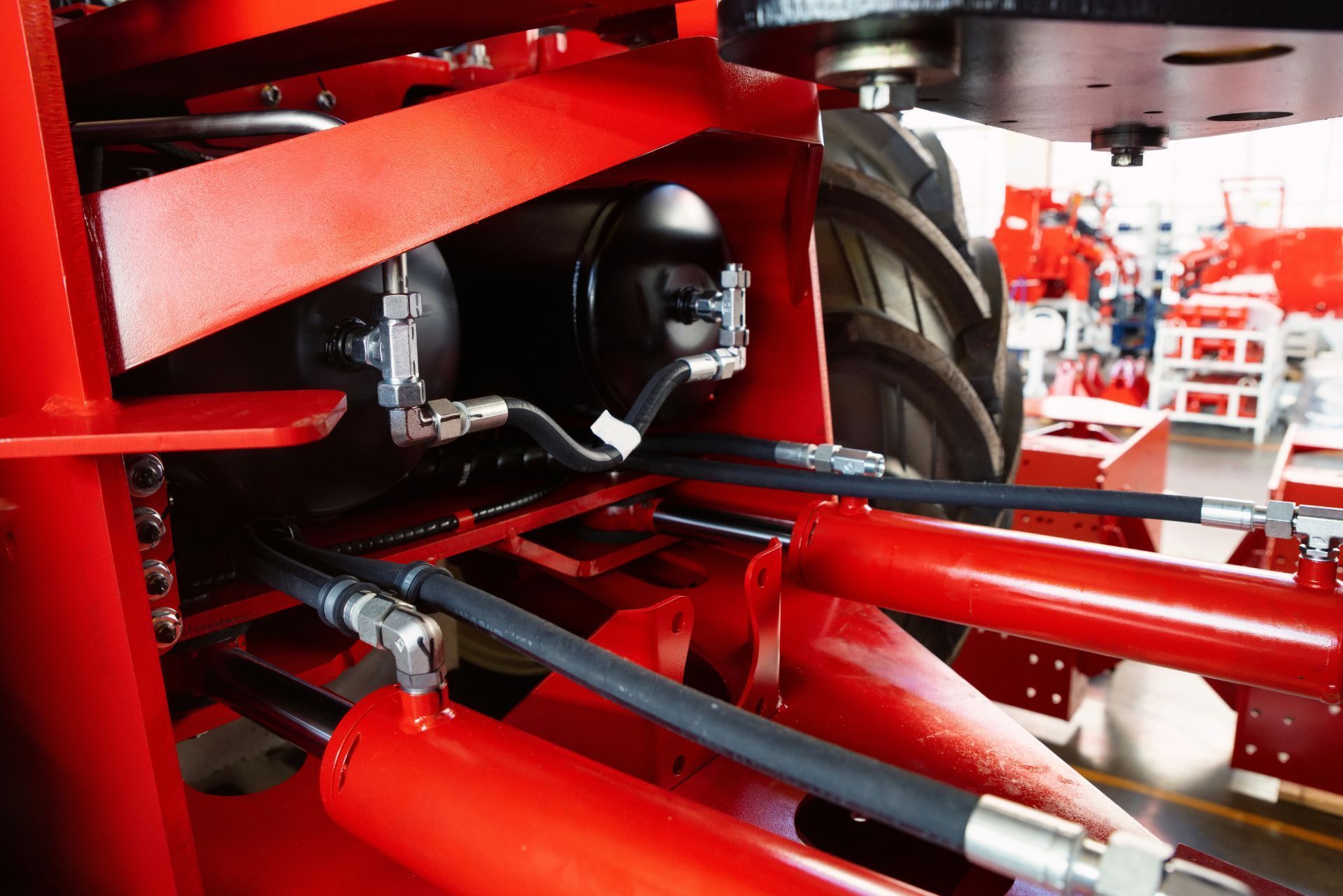

Hydraulic workover units are specialized rigs used primarily for well intervention and maintenance tasks. These units enable operators to perform complex operations such as well repair, stimulation, and plugging without the need for a full drilling rig. Snubbing services, on the other hand, involve the use of hydraulic force to insert or remove tubing from a well under pressure, often in challenging environments like offshore platforms. The versatility of hydraulic workover units allows them to be deployed in various scenarios, from re-entering old wells to enhancing production rates in newly developed fields. Their ability to operate in confined spaces and under high-pressure conditions makes them indispensable in the modern oil and gas industry.

The increasing shale gas production and the rising number of mature fields in regions like Europe and the Middle East have driven demand for these services. North America and the Middle East together hold over 60% of the hydraulic workover unit market, reflecting the strategic importance of these regions in global energy production. This dynamic market environment means companies must be agile and well-protected against operational risks. Additionally, advancements in technology, such as real-time monitoring systems and automated controls, have further enhanced the efficiency and safety of hydraulic workover operations, allowing for quicker response times and reduced human error.

Given the complexity and hazards associated with snubbing and hydraulic workover operations, insurance coverage is not just a regulatory formality but a strategic necessity. It protects companies from financial losses due to equipment damage, operational downtime, third-party liabilities, and environmental incidents. Furthermore, the insurance landscape is evolving, with providers increasingly tailoring policies to meet the specific risks faced by hydraulic workover operations. This includes coverage for emerging technologies and practices, such as the use of drones for site inspections and the integration of artificial intelligence in operational planning. As the industry continues to innovate, staying ahead of these changes will be crucial for companies looking to maintain their competitive edge while ensuring safety and compliance in their operations.

Key Risks in Snubbing and Hydraulic Workover Operations

Operating hydraulic workover units and snubbing services involves multiple risk factors that can impact safety, finances, and reputation. Some of the primary risks include:

- Equipment Failure: Hydraulic workover units and snubbing equipment are subject to intense mechanical stress. Failures can lead to costly repairs and operational delays.

- Operational Hazards: Working in high-pressure environments, often offshore or in remote locations, increases the risk of accidents, including blowouts, fires, and personnel injuries.

- Environmental Risks: Oil spills, leaks, and contamination during well intervention can result in severe environmental damage and regulatory penalties.

- Third-Party Liability: Damage to adjacent infrastructure or injury to subcontractors and third parties can lead to significant legal claims.

- Technological Risks: While automation and digital monitoring have enhanced efficiency by 25%, they also introduce cybersecurity vulnerabilities and potential system failures.

These risks highlight the importance of comprehensive insurance policies that cover equipment breakdown, general liability, environmental liability, and cyber risks. The partnership between SBS Energy Services and Helix Solutions in 2020, which set a new offshore snubbing unit world record, underscores the technical challenges and operational scale involved in this industry, further emphasizing the need for robust risk management strategies through insurance.

Moreover, the integration of advanced training programs for personnel is vital in mitigating operational hazards. Regular drills and simulations can prepare teams for emergency scenarios, ensuring that they are equipped to respond effectively to unforeseen incidents. The implementation of a strong safety culture, where every employee feels empowered to voice concerns and report unsafe practices, can significantly reduce the likelihood of accidents. Additionally, ongoing assessments of equipment and technology can help identify potential failures before they escalate into serious issues, thereby safeguarding both personnel and assets.

Furthermore, the evolving regulatory landscape surrounding environmental protection necessitates that companies remain vigilant and proactive. Adhering to stringent environmental standards not only helps in minimizing risks but also enhances a company's reputation in the industry. Engaging with local communities and stakeholders can foster goodwill and facilitate smoother operations, especially in sensitive ecological areas. This collaborative approach can also aid in developing contingency plans that are tailored to specific environmental challenges, ensuring that companies are prepared to address any incidents swiftly and effectively.

Essential Insurance Coverage for Snubbing and Hydraulic Workover Businesses

Businesses operating in the hydraulic workover and snubbing sector require specialized insurance policies tailored to their unique risk profiles. The following types of coverage are critical:

1. Equipment and Property Insurance

Hydraulic workover units and snubbing equipment represent significant capital investments. Equipment insurance protects against physical damage caused by accidents, natural disasters, or operational mishaps. Given the high cost and technical complexity of this machinery, coverage should include repair and replacement costs to minimize downtime. Additionally, businesses should consider including coverage for loss of income during periods when equipment is out of service due to repairs. This can be particularly crucial in maintaining cash flow and ensuring that operations can resume promptly after an incident.

2. General Liability Insurance

This coverage protects businesses against claims arising from bodily injury or property damage to third parties. Considering the hazardous nature of workover and snubbing operations, general liability insurance is essential to cover legal fees, settlements, or judgments. It is also important for businesses to be aware of the potential for claims stemming from subcontractors or third-party vendors, as these can significantly impact overall liability exposure. Implementing rigorous safety protocols and training programs can further mitigate risks and potentially lower insurance premiums over time.

3. Environmental Liability Insurance

Oil and gas operations carry inherent environmental risks. Environmental liability insurance covers costs related to pollution cleanup, environmental damage claims, and regulatory fines. With increasing regulatory scrutiny, this coverage is indispensable. Moreover, businesses should consider investing in proactive environmental risk management strategies, such as regular environmental audits and compliance training for employees. These measures not only enhance safety and compliance but can also lead to more favorable insurance terms and conditions.

4. Workers’ Compensation and Employer’s Liability

Given the physically demanding and risky nature of snubbing and hydraulic workover tasks, protecting employees through workers’ compensation is mandatory in most jurisdictions. This insurance covers medical expenses and lost wages resulting from workplace injuries. Furthermore, businesses should prioritize the implementation of comprehensive safety programs and employee wellness initiatives to reduce the incidence of workplace injuries. By fostering a culture of safety, companies can not only protect their workforce but also potentially reduce their workers’ compensation premiums over time.

5. Cyber Liability Insurance

As automation and digital monitoring technologies become integrated into hydraulic workover units, the risk of cyberattacks grows. Cyber liability insurance helps cover losses from data breaches, ransomware attacks, and system failures. In addition to obtaining this coverage, businesses should invest in robust cybersecurity measures, including employee training on phishing and other cyber threats, as well as regular system updates and vulnerability assessments. These proactive steps can significantly enhance a company's resilience against cyber threats and may lead to lower premiums as insurers recognize the reduced risk profile.

Choosing the right insurance policies requires a thorough risk assessment and collaboration with insurers experienced in the oilfield services sector. Tailored coverage can help companies navigate the challenges of the industry while capitalizing on growth opportunities. Engaging with a knowledgeable broker who understands the intricacies of the hydraulic workover and snubbing sector can also provide valuable insights into emerging risks and innovative coverage options that align with a company's specific operational needs.

Market Trends Impacting Insurance Needs

The hydraulic workover unit market is evolving rapidly, influenced by technological, regional, and operational trends that shape insurance requirements.

Growth and Regional Dynamics

The market is expected to reach an estimated $11.5 billion by 2030, growing at a CAGR of 3.6% from 2024 to 2030. This growth is driven by escalating shale gas and oil production and a growing emphasis on offshore exploration. The Asia Pacific region’s increasing primary energy demand and the rise of mature fields in Europe and the Middle East further fuel market expansion. These trends increase the volume and complexity of workover operations, necessitating broader and more sophisticated insurance coverage. As new players enter the market, the competitive landscape becomes more intricate, prompting existing companies to reassess their risk management strategies and insurance needs to stay ahead of potential liabilities.

Technological Advancements

The integration of automation and digital monitoring technologies has enhanced operational efficiency by 25%, reducing risks associated with manual operations. However, this also introduces new risks such as system malfunctions and cyber threats. Insurance policies must adapt to cover these emerging risks, including cyber liability and technology errors and omissions. Furthermore, the adoption of advanced data analytics allows companies to predict equipment failures and optimize maintenance schedules, but this reliance on technology can create vulnerabilities. Insurers are now tasked with evaluating the robustness of these technologies and the potential financial implications of their failure, leading to a more nuanced approach to underwriting.

Service Segment Dominance

The workover service segment led the market with a 77% revenue share in 2023, reflecting strong demand for repair, maintenance, and upgrading of existing wells. This trend underscores the importance of insurance policies that cover operational interruptions and equipment failures during these critical services. Additionally, as companies strive to enhance their service offerings, they are increasingly investing in training and development for their workforce. This focus on human capital not only improves safety and efficiency but also necessitates insurance solutions that address workforce-related risks, including employee injuries and liability claims. The emphasis on skilled labor further highlights the need for insurance products that can adapt to the evolving workforce dynamics in this sector.

For a comprehensive market outlook and detailed analysis,

Global Growth Insights offers valuable reports on regional shares and technological impacts.

How to Choose the Right Insurance Partner

Selecting an insurance provider with expertise in the oilfield services sector is crucial. Here are some tips for choosing the right partner:

- Industry Experience: Look for insurers with a proven track record in hydraulic workover and snubbing operations.

- Customized Policies: Ensure the insurer offers tailored coverage options that address your specific operational risks.

- Claims Support: Choose a provider known for responsive claims handling and strong customer service.

- Risk Management Services: Some insurers provide consulting and risk mitigation advice, which can be valuable for reducing premiums and improving safety.

Engaging with a knowledgeable insurance broker can also help navigate complex policy options and secure competitive terms.

In addition to these considerations, it’s important to assess the financial stability of the insurance provider. A company with a strong financial rating is more likely to fulfill its obligations in the event of a claim, providing peace of mind that your operations are protected. Researching industry ratings from agencies such as A.M. Best or Standard & Poor's can give you insights into the insurer's reliability and performance history.

Furthermore, consider the insurer’s commitment to innovation and technology. In the oilfield services sector, advancements in technology can lead to improved safety and efficiency. Insurers that leverage data analytics and risk assessment tools can offer more accurate pricing and better coverage options. This proactive approach not only enhances your insurance experience but also aligns with the evolving landscape of the oil and gas industry.

Conclusion: Protecting Your Business in a Growing Market

The hydraulic workover and snubbing industry is poised for continued growth, driven by rising shale gas production, mature field maintenance, and offshore exploration activities. With the market expected to reach $11.0 billion by 2025 and further expand to $11.5 billion by 2030, companies in this sector face both lucrative opportunities and significant operational risks.

Comprehensive business insurance tailored to the unique challenges of hydraulic workover and snubbing operations is essential for managing these risks. From equipment protection and general liability to environmental and cyber coverage, the right insurance policies safeguard assets, ensure regulatory compliance, and support business continuity.

For companies looking to stay ahead, partnering with experienced insurers and staying informed about market trends is key. As demonstrated by industry milestones like the SBS Energy Services and Helix Solutions project in the Gulf of Mexico, operational excellence combined with robust risk management creates a foundation for sustainable success.

To explore more about the evolving market and insurance solutions,

Lucintel’s industry reports provide in-depth insights into future trends and growth drivers.

Contact Us

Phone

Location

9595 Six Pines Dr, Suite 8210, The Woodlands, TX 77380