Business Interruption vs. Income Insurance for Energy Firms

See How We're Different

Or Call Us: (281) 823-8262

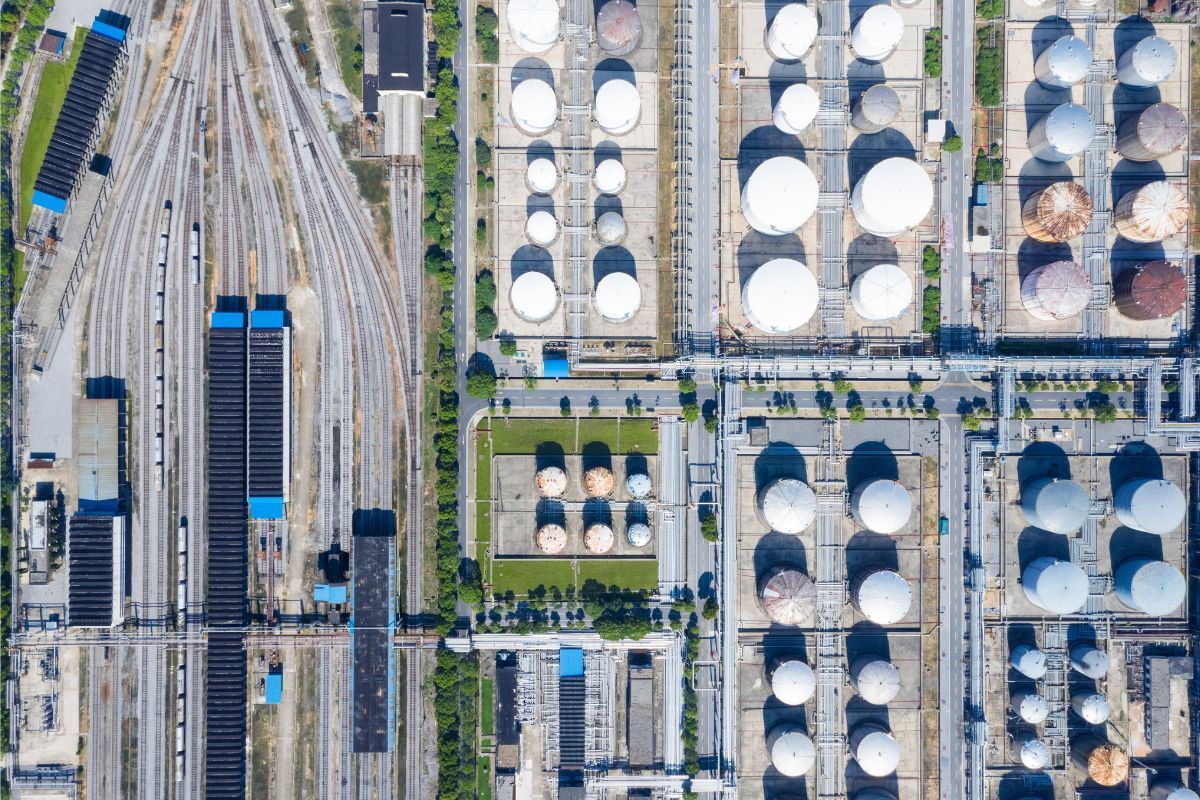

When a hurricane forces an offshore drilling platform to halt operations for six weeks, or a transformer failure shuts down a natural gas processing facility, the financial bleeding starts immediately. Revenue stops flowing while fixed costs continue mounting. For energy firms facing these scenarios, understanding the distinction between business interruption and business income insurance isn't academic: it's essential for survival.

Both coverage types protect against lost income during operational shutdowns, yet they function differently in critical ways that matter to energy companies. The confusion between these terms costs firms millions in underinsurance and claim denials each year. Business interruption coverage and business income insurance share DNA, but their trigger requirements, calculation methods, and coverage scopes can diverge significantly depending on policy language and endorsements.

Energy operations face unique exposure profiles that generic commercial policies weren't designed to address. A refinery experiences different risks than a retail store, and the insurance protecting each should reflect those differences. Your coverage strategy needs to account for volatile commodity prices, complex supply chains, regulatory requirements, and equipment that can take months to replace. Getting this wrong means discovering gaps precisely when you can least afford them.

Defining Business Interruption and Income Insurance in the Energy Sector

Core Mechanisms of Business Interruption Coverage

Business interruption insurance compensates for lost profits and continuing expenses when covered events force operations to cease. The coverage kicks in after a physical loss or damage triggers a property claim, making it functionally an extension of your property policy rather than a standalone product.

For energy firms, this coverage typically calculates compensation based on historical financial performance. Your policy examines revenue trends, operating expenses, and profit margins from the period before the loss occurred. The insurer then projects what you would have earned had the interruption never happened.

Standard policies include a waiting period, often 24 to 72 hours, before coverage begins. This deductible equivalent prevents claims for brief operational hiccups while protecting against catastrophic extended shutdowns. Energy companies with high daily revenue should negotiate shorter waiting periods, as even 48 hours of downtime at a major facility can represent substantial losses.

The Specialized Role of Business Income Insurance

Business income insurance, while often used interchangeably with business interruption coverage, can include broader protections depending on policy structure. Some policies extend beyond direct physical damage to cover income losses from utility service interruptions, civil authority orders, or dependent property damage.

Energy firms benefit from policies that recognize the interconnected nature of their operations. When your natural gas supplier experiences a fire that cuts off your feedstock, business income coverage with contingent business interruption endorsements can respond even though your own property remains undamaged.

The policy period matters significantly here. Unlike property coverage that pays to repair or replace damaged assets, income coverage continues until you've restored operations to pre-loss capacity or until the indemnity period expires, whichever comes first.

Key Differences in Trigger Events and Coverage Scope

Physical Damage Requirements vs. Non-Physical Triggers

Traditional business interruption coverage requires physical damage to insured property before it responds. Your wind turbine must actually sustain damage from a storm; the storm itself creating unsafe conditions isn't enough under most standard forms..

| Coverage Aspect | Traditional BI | Extended BI with Endorsements |

|---|---|---|

| Physical damage required | Yes | Sometimes no |

| Utility failure coverage | Limited | Often included |

| Civil authority coverage | Rarely | Typically included |

| Supply chain disruption | No | With CBI endorsement |

| Waiting period | 48-72 hours | Negotiable to 24 hours |

Energy companies increasingly seek non-physical damage triggers given their exposure to cyberattacks, grid failures, and regulatory shutdowns. These endorsements cost more but address real gaps in traditional coverage. A refinery shut down by EPA order due to emissions violations faces the same financial impact as one closed by explosion damage, but only one scenario triggers standard coverage.

Indemnity Periods and Restoration Timelines

The indemnity period determines how long your coverage will pay income losses. Standard policies offer 12 months, but energy facilities with specialized equipment often need 24 to 36 months. Ordering a custom-built turbine, clearing regulatory hurdles, and completing installation can easily exceed a year.

Your restoration timeline should account for realistic scenarios, not optimistic projections. When a 2021 freeze damaged Texas power plants, some facilities took 18 months to fully restore operations. Companies with 12-month indemnity periods stopped receiving compensation while still operating at reduced capacity.

Extended indemnity periods also protect against market timing issues. If your facility comes back online during a period of suppressed energy prices, you may need additional time to recapture lost market share and restore normal revenue levels.

Risk Profiles Specific to Energy Production and Distribution

Supply Chain Vulnerabilities and Contingent Business Interruption

Energy firms rarely operate in isolation. Your profitability depends on suppliers delivering feedstock, customers purchasing output, and infrastructure connecting the two. Contingent business interruption coverage addresses losses when damage to a supplier's or customer's property interrupts your income stream.

Consider a scenario where your primary pipeline customer experiences an explosion at their facility. They can't accept your natural gas deliveries, forcing you to find alternative buyers at lower spot prices or curtail production entirely. Standard coverage wouldn't respond because your property remains intact.

Contingent coverage comes in two flavors: dependent property coverage for supplier and customer disruptions, and leader property coverage when damage to a nearby property affects your operations without damaging your own. Energy firms in industrial clusters should examine both options carefully.

Market Volatility and Revenue Fluctuation Considerations

Energy prices swing dramatically based on weather, geopolitical events, and economic conditions. This volatility complicates loss calculations because your historical revenue may not reflect what you would have earned during the claim period.

Policies using fixed daily values provide predictability but may undercompensate during price spikes. Actual loss sustained forms offer more accurate compensation but require detailed documentation and can lead to disputes with adjusters unfamiliar with energy market dynamics.

Some energy firms purchase commodity price endorsements that adjust coverage limits based on market conditions at the time of loss. These products add cost but prevent the painful scenario of collecting insurance based on $60 oil prices when the market has moved to $90.

Calculating Loss and Valuation Methods for Energy Firms

Gross Earnings vs. Profits Interest Methods

The gross earnings method calculates loss by taking your projected revenue and subtracting non-continuing expenses. This approach works well for companies with stable cost structures and predictable revenue patterns. You're essentially covered for the profit margin plus fixed costs that continue during the shutdown.

The profits interest method focuses specifically on net profit that would have been earned. This calculation excludes continuing expenses from the coverage amount, resulting in lower premiums but potentially inadequate protection during extended shutdowns when those fixed costs keep accumulating.

| Valuation Method | Best For | Limitation Name |

|---|---|---|

| Gross earnings | Stable operations | May overpay if costs drop |

| Profits interest | Variable cost structures | Ignores continuing expenses |

| Actual loss sustained | Complex operations | Requires extensive documentation |

| Agreed value | Predictable revenue | Inflexible to market changes |

Energy firms with high fixed costs, including lease payments, debt service, and salaried personnel, generally benefit from gross earnings calculations despite higher premiums.

Accounting for Extra Expense and Mitigation Costs

Extra expense coverage pays for costs you incur to maintain operations or accelerate restoration. Renting temporary generators, expediting equipment shipments, or operating from alternative facilities all qualify under typical extra expense provisions.

Energy companies should ensure their extra expense limits reflect realistic mitigation scenarios. Airfreighting a replacement compressor from overseas might cost $500,000 but could reduce your shutdown by three weeks. If your extra expense sublimit sits at $250,000, you're forced to choose between slower restoration or out-of-pocket costs.

Some policies include sue and labor provisions that obligate you to take reasonable steps to minimize losses. Document every mitigation decision and its cost-benefit analysis. Adjusters will scrutinize whether your extra expenses actually reduced the overall claim or simply added costs without proportionate benefit.

Strategic Selection of Coverage for Long-Term Resilience

Choosing between business interruption and business income insurance structures requires honest assessment of your specific vulnerabilities. Start by mapping your critical dependencies: which suppliers, customers, and infrastructure components could trigger income losses if disrupted? Then examine whether your current coverage responds to those scenarios.

Energy firms should request policy reviews annually, not just at renewal. Acquisitions, new facilities, changed supplier relationships, and market condition shifts all affect your exposure profile. A coverage structure that worked three years ago may leave dangerous gaps today.

Work with brokers who specialize in energy risks rather than generalists offering one-size-fits-all solutions. The difference between clarifying key distinctions in your coverage and discovering them during a claim can determine whether your company survives a major loss event.

Frequently Asked Questions

What's the main difference between business interruption and business income insurance? The terms are often used interchangeably, but business income insurance may include broader non-physical damage triggers through endorsements, while traditional business interruption typically requires physical property damage.

How long does business interruption coverage last for energy facilities? Standard policies offer 12-month indemnity periods, but energy companies with specialized equipment should negotiate 24 to 36 months given lengthy restoration timelines.

Does business interruption cover supply chain disruptions? Not automatically. You need contingent business interruption endorsements to cover losses when supplier or customer property damage affects your income.

How are losses calculated for energy companies? Most policies use gross earnings or actual loss sustained methods, calculating projected revenue minus non-continuing expenses over the shutdown period.

Can I get coverage for cyberattacks that shut down operations? Traditional policies exclude cyber events, but standalone cyber policies with business interruption components are available for energy firms facing this exposure.